📑 Research Notes for 2021-05-17

This week, we look at the higher inflation print, implications of higher consumer prices, why the Fed aims for inflation, and the legacy of David Swensen.

We conduct extensive investment research and share the most interesting content that we come across every week. Here is a curated list of this week’s top observations.

Do not reply to this email with any service requests, contact us for support if needed.

Inflation Speeds Up in April as CPI Increases by 4.2%.

(CNBC)

Inflation in April accelerated at its fastest pace in more than 12 years as the U.S. economic recovery kicked into gear and energy prices jumped higher, the Labor Department reported Wednesday.

Sustained Inflation Could Be A 'Black Swan' Risk For The Stock Market.

(Markets Insider)

Bill Ackman said a sustained rise in inflation could be a "black swan" event to markets. He said the US could hit full employment by year-end, forcing the Fed to change its policy stance.

The Fed’s Stimulus Policy Risks Stock ‘Bubble Blowing Up’ and Loss Of The US Dollar’s Reserve Status.

(Forbes)

As inflation fears rattle the market, billionaire hedge fund manager Stanley Druckenmiller is placing the blame on the Federal Reserve's unprecedented efforts to bolster the economy, blasting the central bank’s ongoing pandemic stimulus efforts as “the most radical policy” since World War II—one that could ultimately destabilize the U.S. dollar and tank asset values across the board.

Why the US Wants Inflation.

(Vox)

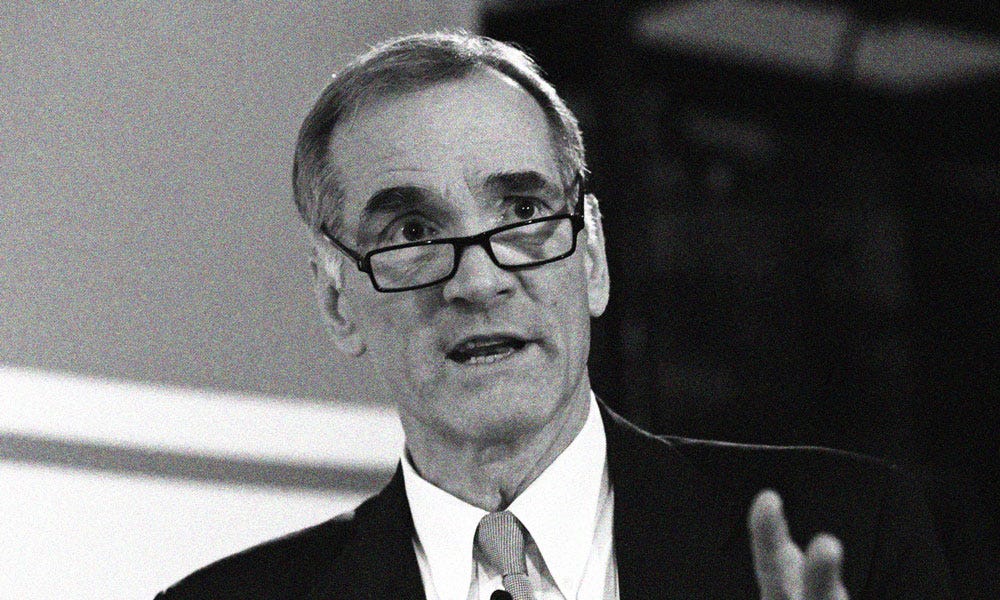

Yale Endowment Chief David Swensen Dies at Age 67.

(New York Times)

David Swensen, the head of Yale's endowment fund and a pioneer in developing a new way to manage money for institutions has passed away this week. He is the creator of 'the Yale Model' regarding asset allocation and investment management.

Curated by Joseph Lu, CFA®

Joseph has over a decade of experience as an investment professional, primarily in quantitative analysis and portfolio management roles. He is the founder and managing director of Conscious Capital Advisors and a CFA® Charterholder. The CFA charter is a globally respected, graduate-level investment credential by the CFA Institute, a global association of more than 90,000 investment professionals working in over 133 countries.

🔗 Connect with us on LinkedIn, Facebook, or Twitter.

Have a question about what we shared? Email us at info@consciouscapital.pro.

Do not reply to this email with any service requests, contact us for support if needed.

The information presented in this newsletter is for educational purposes only and is not a solicitation or recommendation for any specific security, product, service, or investment strategy.

Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a qualified financial advisor, tax professional, or attorney before implementing any strategy or recommendation you may read here.